About the FinTech

Fintech

Financial technology (fintech) is a term used to describe new technology that seeks to improve and automate the delivery and use of financial services.

Key Aspects

Fintech encompasses specialized software, algorithms, and innovations used on computers and smartphones.

Following are the KeyAspect of Fintech in Blockchain

Fintech integrates technology into offerings by financial services companies to enhance their delivery to consumers.

It often involves unbundling traditional offerings and creating new markets.

Fintech companies have expanded financial inclusion by reaching underserved populations.

Technology helps cut down operational costs for financial institutions.

Explore our Block Section to View Use

case of Sil Token in Fintech

Gobal Money

Big Money and Market Capitalization

While headlines often focus on crypto-related fintech, the traditional global banking industry still holds significant market capitalization.

fintech is all about leveraging technology to enhance financial services and make our lives easier!

How to participate

Participating in the fintech industry can be an exciting journey. Here’s a step-by-step guide on how to get started.. . Learn SIL Blog Section, and Learn how to participate in Fintech using Our Sil Chain.

Fintech is a portmanteau for “financial technology”. It refers to new technology that seeks to improve and automate the delivery and use of financial services. Fintech is used to help companies, business owners, and consumers better manage their financial operations, processes, and lives. Fintech includes software, algorithms, and applications for both desktop and mobile. It is used to compete with traditional financial methods in the delivery of financial services.

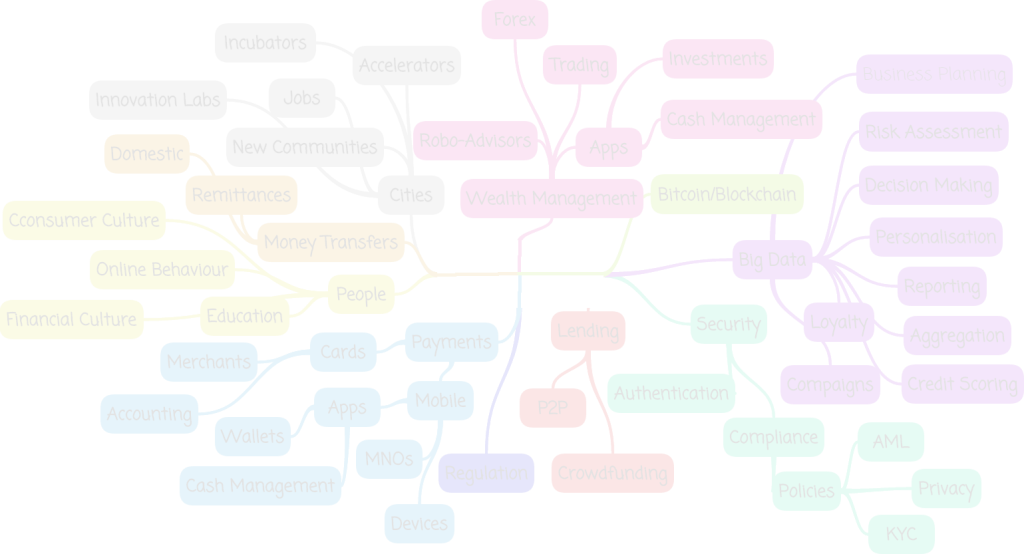

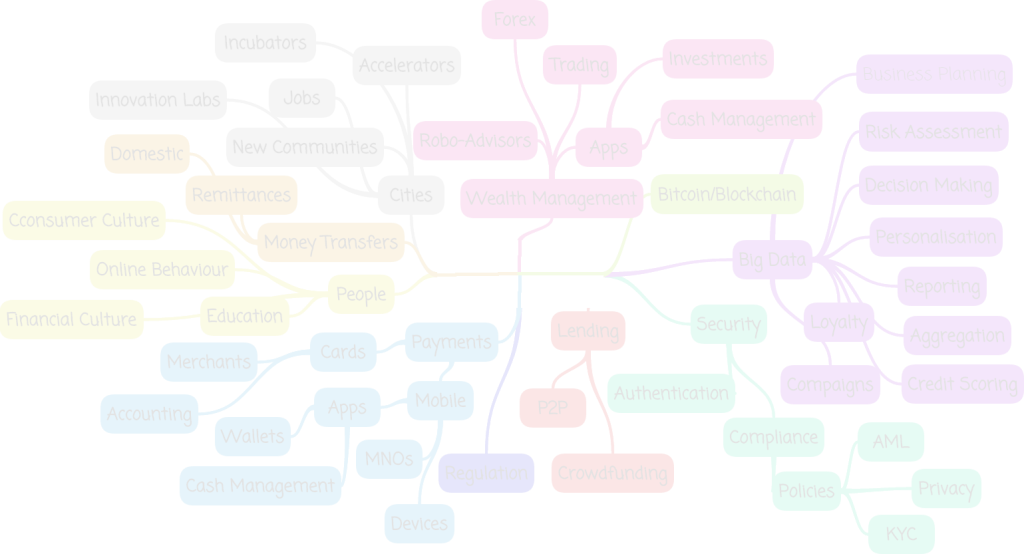

FinTech, short for financial technology, encompasses a wide range of digital solutions that enhance and automate financial services. Let’s explore the main types of FinTech

A fintech company refers to any company that offers financial services or applications that rely heavily on technology. Fintech companies are often industry disruptors—they use technology to change how consumers interact with the financial industry. This often includes expanding access to financial products, lowering fees, and providing faster, more personalized service.

Fintech is often used as a self-identifier, rather than a specific label from an organization that oversees the industry. The best-known examples of fintech companies are fintech banks, however, there are several other fintech verticals that we’ll explore in a later section.

FinTech has revolutionized trading by offering online brokerage platforms, robo-advisors, and cryptocurrency exchanges. These services allow users to invest in stocks, bonds, and digital assets like Bitcoin and Ethereum

Insurtech companies leverage technology to streamline insurance processes, enhance underwriting, and improve customer experiences. Examples include digital insurance platforms and usage-based insurance models.

FinTech companies provide alternative lending options, such as peer-to-peer lending, crowdfunding, and microloans. Additionally, they offer high-yield savings accounts and other innovative deposit products.

Startups and small businesses can access capital through crowdfunding platforms and online marketplaces. These platforms connect investors with promising ventures, bypassing traditional financing channels.

Blockchain technology enables secure and transparent transactions, while cryptocurrencies like Bitcoin and Ethereum have gained prominence as decentralized digital currencies.